south dakota property tax exemption

South Dakota Property Tax Exemption for Disabled Veterans. The states laws must be adhered to in the citys handling of taxation.

.png)

Farm Residence Exemption Morton County North Dakota

Please submit your request to the Department of Revenue Special Tax Division 445 East Capitol Avenue Pierre SD 57501.

. The application deadline has passed for the 2023 assessment - taxes payable 2024The form will be available for electronic submission July 1 2023. Then the property is equalized to 85 for property tax purposes. South Dakota property tax credit.

All property is to be assessed at full and true value. In Vermont disability exemptions can range from a low of 283964 to a high of 283964 based on percentage. The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax.

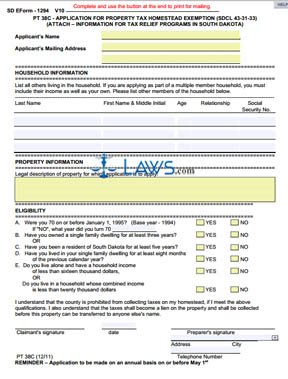

PT 38C - APPLICATION FOR PROPERTY TAX HOMESTEAD EXEMPTION SDCL 43-31-33 TO BE COMPLETED BY DIRECTOR OF EQUALIZATION Applicants Name. Exempts up to 150000 of the assessed value for qualifying property. Applications for these reductions or exemptions can be obtained from and returned to this office or can also be obtained at the SD Department of Revenues links below.

As the owner of real property in South Dakota you have the right to ensure your property is being assessed at no more than market value as. South Dakota state law SDCL 10-4-44 provides a local property tax exemption for renewable energy systems less than 5 megawatts in size. Taxation of properties must.

Other South Dakota property tax exemptions include the disabled veterans exemption which exempts up to 150000 of the disabled veterans property value from taxes. Thank you - South Dakota. Partial exemption of dwellings owned by certain disabled veterans.

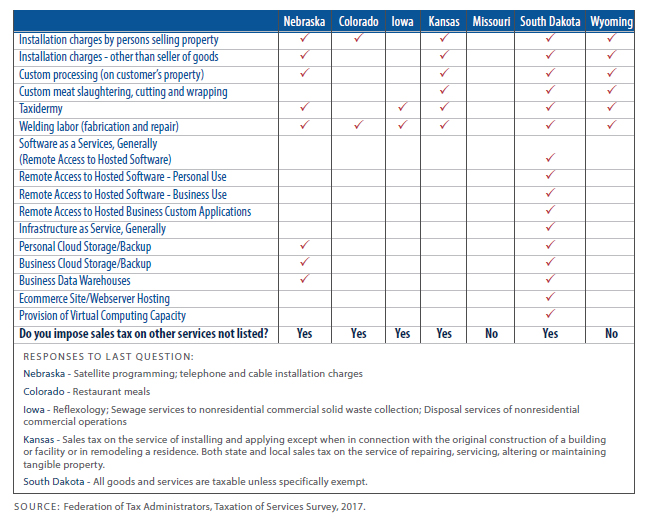

South Dakota offers property tax exemptions for installed solar systems. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. For more information regarding sales tax exemptions please visit pages 11-13.

There are two sections in the South Dakota Constitution that provide property tax exemptions. South Dakota offers a partial property tax exemption up to 150000 for disabled Veterans and their Surviving Spouse. If the county is at 100 of full and true value then the equalization.

One hundred fifty thousand dollars of the full and true value of the total amount of a. Exempt property but is not completely accurate due to inconsistencies in the manner in which the property is valued and reported. Article XI 5 provides a property tax exemption for property of the United States and of the.

11-14-2022 1 minute read. Property tax exemptions allow businesses and homeowners to exclude the added value of a system from. The property subject to this exemption is the same property eligible for the owner-occupied classification To be.

Then the property is equalized to 85 for property tax purposes. In West Virginia veterans may be exempt from property. Applications are accepted from May 1 to July 1.

Starting January 1 2023 the State of South Dakota will be issuing a new plate design for non-commercial and emblem plates with. Property Owner Appeal Process Guide. 1 be equal and uniform 2 be based on present market worth 3 have a single.

Wind solar biomass hydrogen hydroelectric. There are about 5800 parcels of exempt property listed in. Below are the 4 reasons a transaction may be exempt from paying South.

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

Free Form Pt 38c Application For Property Tax Homestead Exemption Free Legal Forms Laws Com

Economic Nexus And The Future Of Sales Tax Youtube

South Dakota State Veteran Benefits Military Com

Exemptions From The South Dakota Sales Tax

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Property Tax South Dakota Department Of Revenue

Which States Do Not Have Property Taxes In 2022 Ny Rent Own Sell

State Tax Treatment Of Homestead And Non Homestead Residential Property

South Dakota S Wacked Out Property Tax System

Free South Dakota Quitclaim Deed Form Legal Templates

/cloudfront-us-east-1.images.arcpublishing.com/gray/MUTCLK5D7JGCTIDI6PJRO3E22I.jpg)

Deadline Approaching For Elderly Disabled South Dakotans To Apply For Property Tax Relief

Property Tax Cut Bill Proposed For Upcoming Session Sdpb

Veteran Tax Exemptions By State